Will conveyancers quit because of AML burden?

Two senior industry figures who spoke to Australian Conveyancer Quarterly – out next week – suggest the added cost and compliance will tip some over the edge.

CONVEYANCERS are considering quitting because of anti-money laundering reforms.

Practitioners may abandon the profession as a result of the Anti-Money Laundering and Counter Terrorism Financing legislation.

Two senior industry figures who spoke to Australian Conveyancer Quarterly – which is out next week – have suggested the added costs and compliance will tip some over the edge.

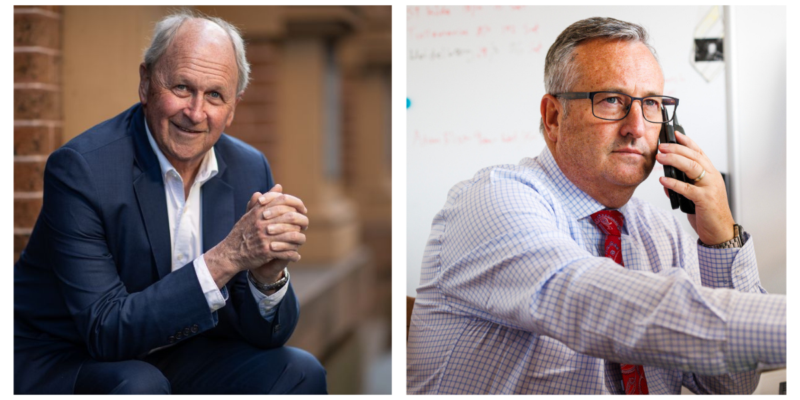

The new legislation that comes into force in July 2026 is likely to add $1,000 in costs per practice per year, AICNSW chief executive Chris Tyler said.

He also reckons added compliance requirements could tack an extra hour onto a busy conveyancer’s day.

That extra burden could even force some conveyancers to shut up shop.

“I’ve spoken with some older conveyancers who say they won’t be in business past June, 2026,” he said.

Veteran conveyancer and trainer Garth Brown – who is profiled in the magazine – also came to that conclusion, but urged practitioners to get ahead of the reforms.

For both, increasing compliance burden is the bane of the conveyancing community’s existence.

Financial crimes watchdog AUSTRAC is creating starter programs for conveyancers because it recognises that a large proportion of conveyancing businesses, and indeed legal practices, in Australia are small.

“They’re one person operators,” Chris Tyler said as he explained the extra burden placed on practitioners.

“Under the AML legislation, a sole practitioner will have to register with AUSTRAC as a reporting entity.

“They’ll have to be the compliance manager of the program. They’ll have to administer the program.

“And will have to ensure that it’s adhered to during the year. Then, every three years, that will be examined.”

Part of his frustration is that AUSTRAC has appointed external consultants to create the AML starter programs.

“But the fact is the external consultants are not conveyancers and don’t sit in front of clients doing the conveyancing work,” he says.

“I’m not casting aspersions. They may be legally qualified, but it’s so critical that they get people who are the actual practitioners to sit in on these consultations, and that they take notice of what we say.”

Look out for more from Chris – including ongoing issues with the NSW Government to and Revenue NSW – and the full interview with Garth next week in the new Australian Conveyancer Quarterly.