Will conveyancers walk away over AML/CTF reforms?

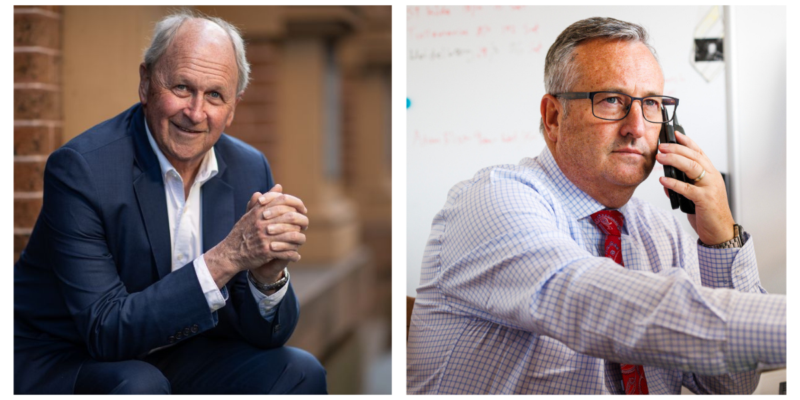

With Tranche 2 anti-money laundering rules around the corner, that's one of the questions we asked award-winning conveyancer and trainer Garth Brown who gives his expert view on what the reforms will mean for the sector.

AUSTRALIAN CONVEYANCER: Are AML Tranche 2 reforms needed?

GARTH BROWN: Yes. From my 30 years of experience, the laws up until now have not been strong enough to counter criminals who use illegal money to buy and sell real estate to hide their proceeds from crime. Tranche 2 provides much-needed reforms to strengthen anti-money laundering in Australia.

AC: When will the AML changes start to affect the conveyancing industry?

GB: Australia’s AML has a launch date of July 1, 2026. Between now and the launch, professionals have an opportunity to bring their knowledge up to speed and initiate all the policies and procedures required in their firm to be AML ready. And I would urge conveyancers to take that opportunity. Start now. Do not delay. It will make the transition much easier to implement.

AC: What does this mean for conveyancing and legal professionals?

GB. Firstly, all conveyancers and lawyers involved in large transactions will need to exercise more due diligence and take the blinkers off to scrutinize where large cash amounts come from and ask the hard questions. If a conveyancing client wants to pay a $10,000 or $20,000 cash deposit and/or pay large cash instalments, they will have to ask: “where did this cash come from?”

Reporting the cash to AUSTRAC will be a critical part of the reforms.

Tips: Start preparing your firm “now” to have an understanding of what likely the AML stipulated procedures will be, complete AUSTRAC’s 10 eLearning modules, and use your energy to support the initiatives rather than resist them.

AC. What are the main problems for conveyancers when the new laws are rolled out next year?

GB. This will place extra burdens and regulatory procedures on each conveyancing file. More time and extra money for additional file due diligence will need to be applied to an already exhaustive set of procedures to comply with at present, e.g., ATO, Rules of Conduct for conveyancers, and demands of clients and pressure from other stakeholders such as real estate agents to exchange contracts and settle properties. What new AML file procedures mean for Conveyancing Practitioners is to ask Clients more questions and to Know Your Client (KYC) better.

AC: When do conveyancers need to undertake extra AML due diligence?

GB: At initial instructions, KYC means additional due diligence to raise questions to Vendor and Purchaser clients at the Contract beginning.

Conduct a risk assessment through questions about how the large sum of money was raised to settle without a bank involved or what the client does for work. Questions to raise when acting for companies and trusts – who are the beneficial owners? If the client is overseas – are they a politically exposed person? Do they reside in a country known for corruption? With transfers over $10K to your trust account – these transactions are required to be reported to AUSTRAC.

Conveyancers and lawyers will need to keep and maintain AUSTRAC records daily, engage with and understand new technology to liaise & report Conveyancing transactions to AUSTRAC. Now is a good time to start arranging who would be responsible for keeping daily computer records and logs with AUSTRAC reporting on vendors and purchasers of Property. AUSTRAC will issue infringement notices for failure to report or keep records up to date via a firm’s digital platform.

AC: Looking at cost to the industry, figures vary from $11 billion over a decade (according to government services opposition minister Paul Fletcher) to $2 billion a year (according to the Real Estate Institute). Elsewhere I’ve seen estimates of $100,000 a year per firm, based on NZ experience.

GB: Every conveyancer or lawyer must make changes to their practice by charging additionally for the time and specialized knowledge/education to manage the AML risk. No matter what size a conveyancing practice is, work out the time needed to assess AML risk, apply a dollar amount per hour, and charge for your work. A risky file requires a higher fee for the AML file procedures.

There are other ways to charge for AML compliance with clients? A combination of a flat fee, per file basis, or a percentage of the sale price or deposit paid, adjusting depending on whether the client is high, medium, or low AML risk.

AC: Do you think it is going to lead to any conveyancers walking away from the sector?

GB: Yes, some conveyancers will walk away, having had enough of the additional regulatory burdens. I believe that after AML procedures are implemented, there will be more changes and regulatory burdens, and these will not stop as time moves forward. My advice is to adapt, pivot to the new AML procedures, and enjoy what you are doing by being well-paid and respected as a professional.

AC: Why is confidentiality another area of concern for conveyancers?

GB: AUSTRAC places an obligation on conveyancers not to advise a vendor or Purchaser that their conveyancing transaction is being reported to AUSTRAC. This represents a real change in conveyancing ethics, circumventing client privilege.

The purpose of AML reporting is to stop criminals from moving funds into property. So if a practitioner were to advise the client that their transaction is being reported to AUSTRAC as suspicious, the whole system would be undermined.

The form of reporting to AUSTRAC may involve preparing an online Suspicious Matter Report (SMR) or an additional S49 online report for more thorough details for AUSTRAC to follow up on and investigate. These reports cannot be used in court; they serve as a basis for AUSTRAC to start tracking suspicious conveyancing transactions.