Key AML dates for conveyancers as new rules are rolled out

Timeline for the introduction of Tranche 2 reforms that will bring practitioners under AUSTRAC scrutiny.

AUSTRAC has released a timeline of key dates for the rollout of new tranche 2 anti-money laundering laws.

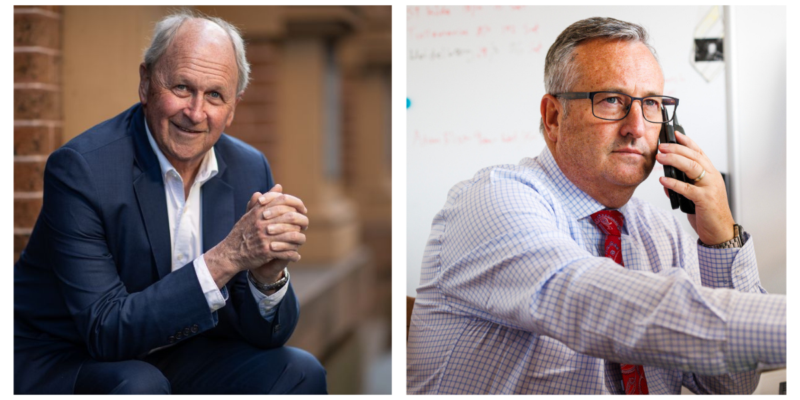

The financial crimes regulator has held a series of forums where chief executive Brendan Thomas outlined plans for AML reforms to conveyancing industry associations.

These forums are set to continue as AUSTRAC continues to work out the anti-money laundering and counter-terrorism financing (AML/CTF) rules for conveyancers and others who will come under scrutiny from next year.

“These industry forums establish effective communication channels between AUSTRAC and industry that will help us share information and consult about the reforms regularly,” the regulator said.

“They also allow industry to ask questions, comment and provide feedback on aspects of the reform, like draft Rules and guidance.

“Once the implementation of the AML/CTF reform work is complete, the forums will continue as a means of communicating important information to industry, maintaining effective working relationships with industry associations and staying up-to-date with any challenges facing the various sectors.”

The other dates AUSTRAC highlighted in its latest message, include:-

- July to August 2025: Public consultation on draft core guidance

- July 2025: Finalisation of AML/CTF Rules

- September 2025: Finalisation of core guidance

2026

- January 2026: Finalisation of tranche 2 sector-specific guidance

- 31 March 2026: Changes to obligations for current reporting entities and virtual assets service providers

- 1 July 2026: AML/CTF obligations commence for tranche 2 entities

- 2026: Ongoing enhancements to the sector-specific guidance for current reporting entities in partnership with industry

- Post 2026: International value transfer service reporting will commence under transitional arrangements (previously referred to as ‘international funds transfer instruction’ reporting).

Another date to note is Australia’s next inspection by the Financial Action Task Force FATF which is scheduled for 2026.

The FAFT assesses the effectiveness of Australia’s AML/CTF measures to combat money laundering, terrorism financing and financing of the proliferation of weapons of mass destruction.

As Attorney-General Mark Dreyfus, a poor assessment would risk Australia being grey-listed by FATF.

Being grey-listed would mean Australia would be under increased monitoring by FATF and have serious economic and reputational consequences.

Research indicates that grey-listed countries experience a decline of 7.6 per cent in GDP and three per cent of foreign direct investment.