Early access to super for first time buyers will send prices soaring

Capital city median prices could rise by up to $92,500 and add $260 a fortnight to a homebuyer’s mortgage, a study claims.

ALLOWING first home buyers to use super for house deposits could see prices hike by 10.3 per cent, a new study shows.

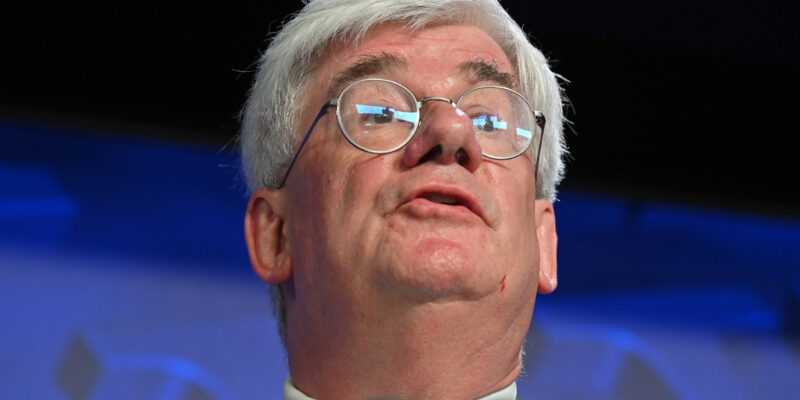

Capital city median prices could rise by up to $92,500 and add $260 a fortnight to a homebuyer’s mortgage, University of South Australia professor Chris Leishman claims.

The Super Members Council-commissioned research uses econometric modelling to estimate the price impacts of a Coalition policy proposal for first home buyers to withdraw $50,000 from super for a home deposit.

“It is an uncontroversial finding,” Professor Leishman said.

“If you add demand to an inelastic market, prices are going to rise, with the unintended consequence of making housing less affordable.”

Evidence from New Zealand found after that country introduced a super for house scheme, house prices took off – growing at twice the rate of those in Australia.

Home ownership rates fell by 7 percentage points for Kiwis in their 30s, a key first home buyer demographic.

Super Members Council CEO Misha Schubert said a vast body of expert evidence was crystal clear that early withdrawals of super for house deposits would just push up house prices further and faster – pricing more Australians out of owning their own home.

“Raiding retirement savings for house deposits would just unleash a supercharged price hike in house prices, not create more new home buyers,” Ms Schubert said.

“That would mean home buyers in future would have to pay higher repayments on bigger mortgages for longer, worsening housing affordability and cost-of-living pressures on younger Australians.

“The international literature is clear, the lived experience in New Zealand is clear, and detailed and rigorous econometric models are clear – taking super out for house deposits will just further drive-up house prices, fuel higher mortgages and debt stress in a cost-of-living crisis.”

It would push the Great Australian Dream of home ownership even further out of reach for many young Australians,” she said.

“And if people retire with less super, that will also push up age pension costs – a bill that every Australian taxpayer would pay.”

SMC analysis shows a 30-year-old who withdrew $35,000 from their super today could retire with about $195,000 less in today’s dollars.

The overwhelming majority of Australia’s leading respected economists say the housing supply and affordability crisis needs to be tackled with other policies – in a recent Economic Society of Australia survey, only 1 out of 49 top economists supported withdrawals of super for housing.

In a comprehensive report in 2024, respected independent economist Saul Eslake showed policies that allow Australians to pay more for housing just result in more expensive homes rather than a higher proportion of people owning housing.