Jail threat for conveyancers who tip off clients they suspect of money laundering

AUSTRAC obligations on conveyancers and property lawyers represent a real change in ethics and client privilege, according to practitioners.

CONVEYANCERS coming under AUSTRAC regulation from next year could face jail or fines of up to $39,000 if they tip off clients they suspect of AML offences.

That’s the stark reality of the latest update from the financial crimes regulator, which has highlighted changes to it tipping off rules.

These rules mean businesses and individuals bound by the tipping off offence have to consider whether a disclosure could be expected to prejudice an investigation.

The changes to the offence, which carries a maximum penalty of around $39,000 or up to two years in prison, are now focused on the harms that could flow from a disclosure.

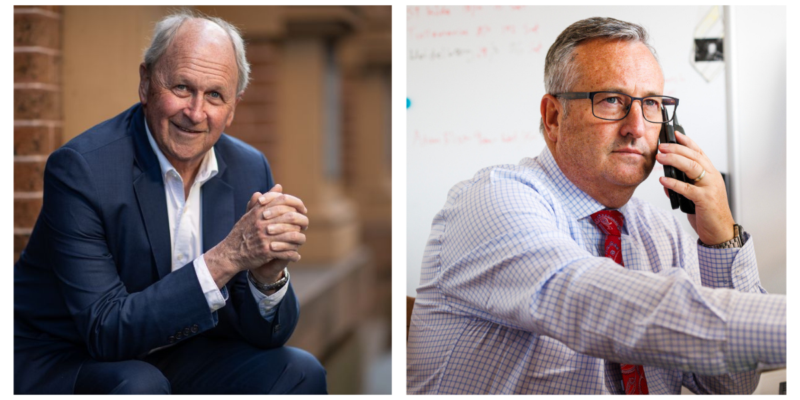

AUSTRAC chief executive Brendan Thomas said the change is there to simplify the legislation.

“The previous legislation was almost 20 years old and a lot has changed in that time,” he said.

“AUSTRAC is about to usher in 100,000 new businesses to the regime next year and they too will be subject to the tipping off offence.

“The change to the offence is about balancing intelligence gathering with practicality to ensure we can all get the best outcome – identifying criminal activity and driving money laundering out of legitimate businesses.

“We need businesses to work with us to detect illicit transactions – tipping off risks criminals getting a heads up.

“Criminals can then take action to hide or disguise their illegal activities. However, we know that effective information sharing within and between businesses helps stop money laundering.”

Businesses and individuals covered by the AML/CTF legislation, including banks, casinos, remitters and money lenders, are now prohibited from disclosing certain information to another person (other than AUSTRAC), only where it would or could reasonably be expected to prejudice an investigation.

“The move to a focus on harms strikes a better balance between protecting law enforcement investigations and allowing industry to collaborate in fighting money laundering, terrorism financing and other serious crimes.”

While the tipping off offence changes from today, most of the obligations under the amended AML/CTF Act will not come into effect until 2026, when entities in real estate, conveyancing, accounting, precious stones and metals and digital assets come under AUSTRAC’s remit.

When the reforms were passed last November, Law Council President Greg McIntyre said: “Our concerns centre on aspects that will damage the trusted relationship lawyers must be able to have with their clients.”

In his in-depth Q&A, veteran conveyancer and trainer Garth Brown highlighted the fundamental impact of Suspicious Matter Reports.

“AUSTRAC places an obligation on conveyancers not to advise a vendor or purchaser that their conveyancing transaction is being reported to AUSTRAC,” he said.

“This represents a real change in conveyancing ethics, circumventing client privilege.”