Lawyers, conveyancers – and even regulators – confused over AML

AUSTRAC is involved in a 'frenetic' amount of activity as the number of businesses it monitors is set to jump from 15,000 to 90,000.

ANTI-MONEY laundering reforms that will be in place by this time next year are confusing most lawyers.

The regulators, too, still don’t know what they’re supposed to do under the legislation, judging by comments at a recent Queensland Law Society symposium.

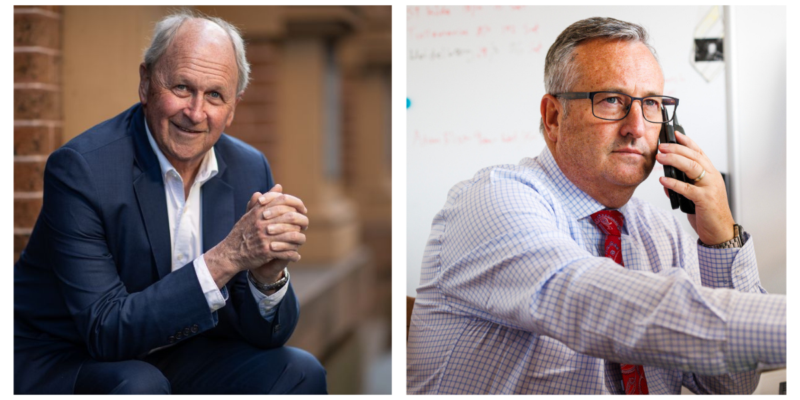

Chief executive Matt Dunn told the audience: “It’s confusing.”

Under the government’s reforms being rolled out by AUSTRAC, practitioners will become reporting entities who have to report to the financial crimes regulator as part of efforts to clean up Australia’s $11 billion money laundering shame.

But the CEO told lawyers who were eager to understand their obligations under the Tranche 2 reforms: “There isn’t enough time.

“There’s a lot of industry consultation going on.

“But what we are really interested in is how that’s going to work on the ground.

“The consultation’s not necessarily been one of their strongest points given the amount of work there is to be done across multiple industry sectors,” he said of AUSTRAC.

Even major players are struggling – and pushing back against the reforms – with the Australian Banking Association submitting a 1,000-page response to financial crimes regulators first draft of the reforms.

“That’s going to take them months to get through.”

The sheer numbers of those who will be scrutinised by AUSTRAC is also daunting – not least for the financial crime regulator.

“There is an absolutely frenetic amount of activity that AUSTRAC is doing at the moment,” he explained.

“They’re dealing with their existing industries with a completely new scheme and a whole lot of new providers that don’t know how it’s all meant to work.

“They were a little bit worried that they found out that this is probably about another 90,000 reporting entities in Australia and they’re not ready for numbers of that scale.

“At the moment, AUSTRAC is just coming to understand the enormity of the task that they have and I think they now realize there isn’t enough time to do the work.”

Minter Ellison partner Ian Lockhart added: “The legislation is a massive expansion of the number of people who are captured, from 15,000 businesses to 90,000.”

Also adding to the confusion is AUSTRAC’s decision to move away from rigid rules. leaning on “guidance” and “interpretation” instead.

That approach is making things worse, not better, Dunn added.

“We want safe harbours. We want certainty. We don’t want variability.”

Right now, there’s no clarity on what will be required — or how compliance will be judged.

Clock ticking on ethical turmoil

Under current timelines, Tranche 2 legal and professional services must enrol from March 1, 2026 with full AML obligations in force from July 1.

Transaction reports, suspicious matter reports and international transfer declarations aren’t optional.

“If you feel the matter is suspicious… there’s a positive obligation on the legal practitioner to make a report to AUSTRAC,” he pointed out, noting that for lawyers the idea of reporting on clients is deeply uncomfortable.

“Dobbing on our clients is not something that is part of our ethical obligations. Our job is to counsel our clients to not break the law.

“It’s quite problematic, especially if it means people don’t get the advice they need to stay on the right side of the law because they feel their lawyer will report them. That is not a good policy outcome.”

With international pressure from FATF, the global financial crime watchdog, and its review of Australia’s performance, the law society CEO suggested that “the Australian government’s running scared of a bad international report card”.

And in a shot across the bows to the legislation, he likened it to cleaning in a panic before guests arrive.

“When you’ve got someone coming over for dinner, and you’re hiding all the mess on your tables, in your cupboards, under the beds — trying to make it look like it’s good for the day,” he said.